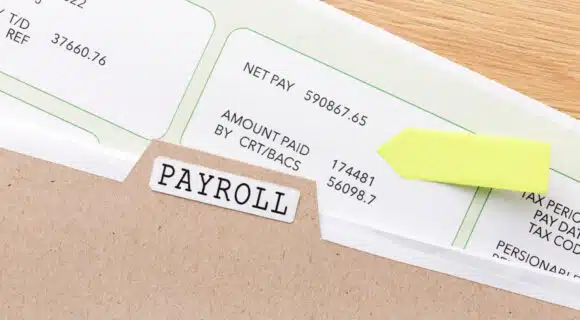

Effective tax planning is more than a compliance necessity—it’s a strategic advantage for small business owners on the Gold Coast and Tweed Heads. As we delve into the world of tax planning, it’s essential to highlight key strategies that can significantly impact your business’s financial health. Strategies like leveraging instant asset write-offs, making the most […]

Read MoreBlog

In the bustling business landscape of the Gold Coast and Tweed Heads, small business owners face unique challenges and opportunities. Deep-rooted in these communities, Grow Advisory Group understands these dynamics intimately. Drawing insights from the 2024 NAB Professional Services report, this article reveals how tailored accounting services are not just about numbers but pivotal in […]

Read MoreAt Grow Advisory Group, our 20+ years of experience as business accountants on the Gold Coast and Tweed Heads have given us a front-row view of the financial challenges that local businesses often face. Among the most common pitfalls we see are poor cash flow management, neglecting timely tax planning and compliance, and the risky […]

Read MoreIn the current intricate financial environment, the demand for tax accountants on the Gold Coast—and across Australia—has reached unprecedented levels. But why are tax accountants in such high demand? While our tax accountants would like to think it’s due to their good looks and personalities, the real reason behind this demand is far more practical. […]

Read MoreMany enterprises grapple with growth, strategic planning, and overall performance improvement in the ever-evolving and competitive business landscape. This is especially true here on the Gold Coast, a vibrant hub with businesses of all sizes and industries. As Gold Coast business advisors, we at Grow Advisory Group have seen firsthand how these challenges can hinder […]

Read MoreIn 2024, the accounting landscape is set to undergo transformative changes, shaping the way professionals and businesses navigate financial complexities. This article explores ten pivotal trends predicted to dominate the Australian accounting sector. From the widespread adoption of AI and automation to the nuances of blockchain technology and sustainability reporting, these trends are not just […]

Read MoreIf you’re a business owner, entrepreneur, or manager, you’ve likely faced the challenge of managing your finances effectively. This task is crucial, yet it can often seem overwhelming, particularly when focusing on growing your business. But what if there was a solution that could simplify this process and fuel your business growth? Enter bookkeeping and […]

Read MoreDo you feel overwhelmed by the financial side of running your business? You’re not alone. Many Gold Coast business owners are in the same boat, unsure where to seek help. That’s where business bookkeeping comes into play. Bookkeeping is the silent hero of successful businesses, diligently crunching numbers and ensuring everything adds up. It plays […]

Read MoreFor many providers, understanding and navigating the tax obligations of the National Disability Insurance Scheme (NDIS) can feel like navigating a complex maze. As an NDIS provider, your responsibility is to deliver exceptional care and support to individuals with disabilities. But managing your tax responsibilities under the NDIS can divert your focus from this primary […]

Read MoreNavigating the financial landscape of the National Disability Insurance Scheme (NDIS) can be a daunting task for many providers. There are unique challenges and complexities that require specialised knowledge and expertise. As an NDIS provider, you might find yourself asking, “How can I efficiently manage my financial obligations under the NDIS while also focusing on […]

Read MoreIn the world of NDIS providers, balancing the demands of service delivery with complex financial responsibilities is often a challenging act. As an NDIS provider, you might find yourself grappling with intricate accounting requirements while striving to provide top-notch care to those who need it most. But what if there was a way to ease […]

Read MoreOperating as an NDIS provider comes with a unique set of financial challenges. Amidst delivering quality care and support to your clients, you may find yourself grappling with complex accountancy tasks specific to the NDIS landscape. The question arises: “How can I focus on my primary role as a care provider while also managing my […]

Read MoreAs an NDIS provider, you’re well aware of the critical role you play in supporting Australians with disabilities. However, alongside this crucial duty, another aspect of your operation is equally important – NDIS bookkeeping. Yes, we’re talking about those numbers and financial reports that can sometimes make your head spin. Effective bookkeeping is the unsung […]

Read MoreNavigating the complex world of private financing on the Gold Coast can be daunting for individuals and businesses. With the ever-changing financial landscape, securing the right loan to meet your unique needs may seem insurmountable. But fear not—help is at hand! At Grow Advisory Group, we understand the intricacies of private funding for the Construction […]

Read MoreAs a business owner or individual on the Gold Coast, you understand that sound financial management is essential for success. Whether it’s making sure your books are up-to-date and accurate, staying compliant with regulations, or understanding how to maximise your investments, having an experienced accountant by your side can make all the difference. At Grow […]

Read MoreAs a small business owner or entrepreneur on the Gold Coast, you know the importance of bookkeeping for success. But when it comes to tackling the financial management aspect of your business, many people find themselves overwhelmed and unsure of where to start. At Grow Advisory Group, we understand small businesses’ challenges when managing their […]

Read MoreIn the ever-evolving world of finance, navigating the complex landscape of private funding can be a challenge for property developers, construction companies, contractors, and individuals seeking alternative financing solutions. As the demand for private financing on the Gold Coast continues to grow, staying informed about emerging trends is crucial for borrowers looking to secure the […]

Read MoreAre you a property developer, business owner, or individual seeking alternative financing solutions but unsure which option best suits your needs? The financial landscape can be overwhelming, especially when deciding between private funding and traditional loans. In today’s article, we aim to clarify these two financing options, explore their benefits and drawbacks, and help you […]

Read MoreAs an entrepreneur or small business owner on the Gold Coast, you know the importance of having access to business loans. A loan can help you with your business expansion plans and give you the capital needed for success. However, accessing business loans on the Gold Coast can be tedious, stressful, and confusing. Specific requirements […]

Read MoreAs a Gold Coast homeowner, you know that selecting the right home loan can be daunting and confusing. You want to make sure you choose the right option for your financial situation and future goals. We understand that choosing between a fixed rate and variable rate home loan can be a difficult and overwhelming decision. […]

Read More